workers comp taxes texas

Let our Experts Guide you to the Right Workers Comp Insurance Plan. Each year TWC calculates the RTR using this formula.

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

Texas law does not deem compensatory damages awarded for.

. If you have any. Enter Your Zip to Start. You do not need to claim the income benefits from workers compensation you receive on your taxes.

Home Are Workers Compensation Settlements Taxable in Texas. You will typically not have to pay taxes on a workers compensation settlement at the state or federal level in Texas. Employer costs for unemployment insurance and workers compensation are relatively low in Texas.

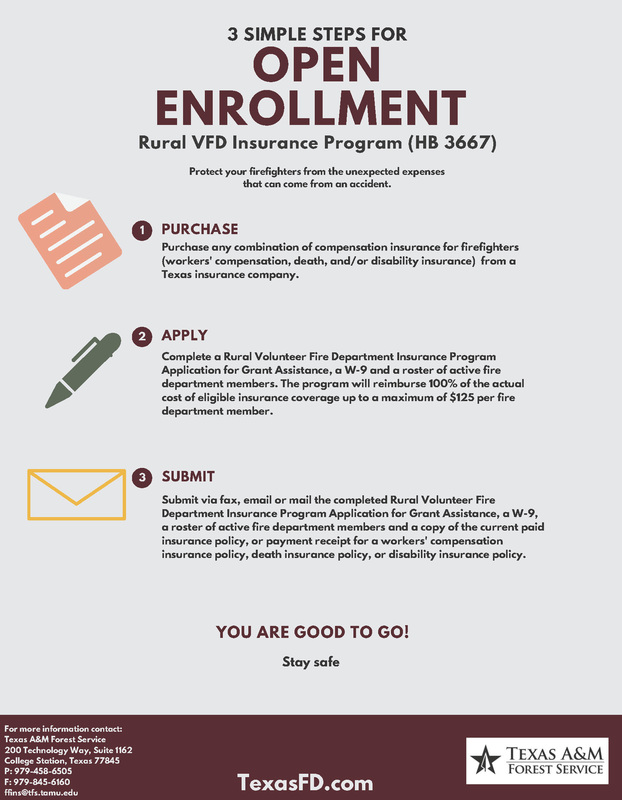

Select Popular Legal Forms Packages of Any Category. Penalties and Interest Penalties Interest Reporting and Payment Requirements Select the amount of taxes you paid in the preceding state fiscal year Sept. The Texas Department of Insurance is working hard to provide you with information you need to make informed choices about workers compensation insurance.

Texas unlike other states does not require an employer to have workers compensation coverage. RTR One-half benefits paid but not charged to any employer One Years Total Taxable Wages The RTR for 2022 is 020. Discover ADPs Workers Comp Premium Payment Program Pay-By-Pay.

Ad Get Workers Comp Insurance For Your Business From ADPIA. Subscribing to workers compensation insurance puts a limit on the amount and type of. Lost working time concern over lost wages doctor.

All Major Categories Covered. Vary each year as. Unemployment Insurance Workers Compensation.

Ad Its Fast Easy To Get Workers Comp Coverage. The rate is effective October 1 2022 through December 31 2022. DWC has determined that any interest or discount provided for in the Texas Labor Code shall be at the rate of 746 percent.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Insurers licensed by the Texas Department of Insurance and self-insurance groups that write workers compensation insurance coverage must pay this tax. The Medicare tax rate is 145 of all earnings of both employees and employers.

31 to find the reporting and. After an accident at work there are plenty of stresses to deal with. The benefits from workers compensation are typically not taxable in Texas.

Additional Medicare tax needs to be paid depending on the filing. Sole Props Entrepreneurs Small Shops Side Hustles. Ad Compare Texas Workers Comp Insurance Quotes Online Save 55 - 75.

Workers Compensation Laws By State Embroker

Texas Mutual Looks To Sever Last Ties To State Oversight

Dfw Workers Compensation Lawyers Texas Workers Comp Attorneys

News Blog Vfis Of Texas The Leading Insurer Of Emergency Organizations In Texas

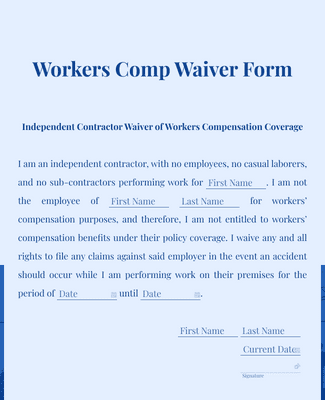

Workers Comp Waiver Form Template Jotform

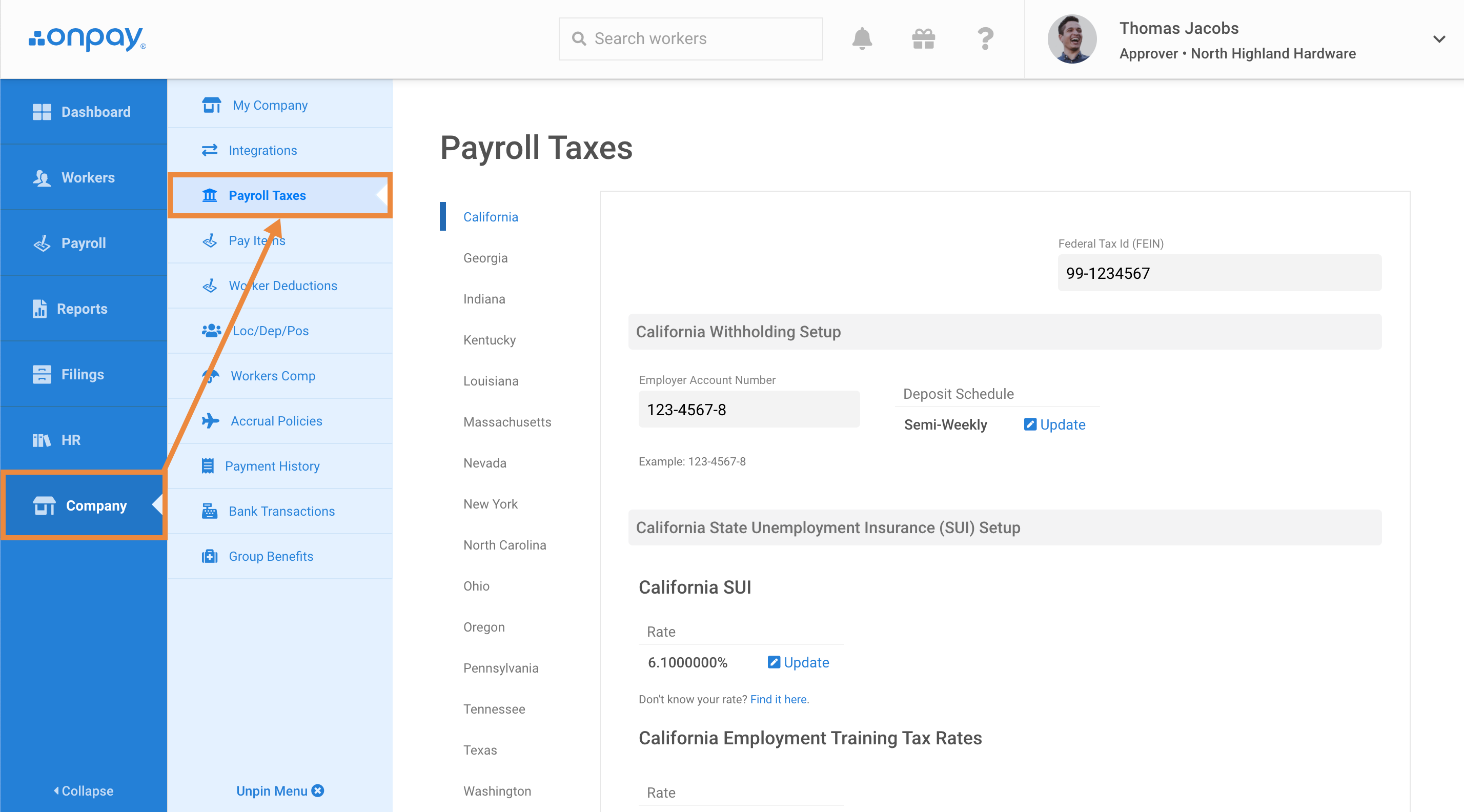

Add Or Update State Payroll Tax Information Help Center Home

Texas Workers Compensation Act Texas Worker

County Commissioners Adopt Reduced Tax Rate News Palestineherald Com

Texas Workers Compensation Handbook Lexisnexis Store

Texas Small Business Scorecard March 2019

Ibaw 5 Star Workers Comp Texas Mutual

Are Workers Compensation Benefits Taxable In Texas Sutliff Stout

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

Form Dwc81 Download Fillable Pdf Or Fill Online Agreement Between General Contractor And Subcontractor To Provide Workers Compensation Insurance Texas Templateroller

The Fallout Of Workers Comp Reforms 5 Tales Of Harm Propublica

Inside Corporate America S Campaign To Ditch Workers Comp Propublica

Workers Comp Waiver Texas Pdf Fill Online Printable Fillable Blank Pdffiller

Workers Compensation Deadlines All 50 States Workinjurysource Com

New Tax Laws Benefit Texas Workers In Alternative Plans Partnersource